The Post Millennial reported the Central Bank of Nigeria (CBN) plans to limit withdrawals to $225 U.S. dollars or 100.000 nairas weekly. The intent is to move toward digital currency and away from its paper counterpart since criminals demand ransom in the paper version.

Authorities believe the policy will make it harder for kidnappers to avoid the authorities and receive ransom demands.

December 12, 2022

The Post Millennial reported that $6.5 billion was demanded by kidnappers between July 2021 and June 2022. Kidnappers collected $1.4 million of that amount. During that same period, out of 3,500 people involved in kidnappings, there were over 500 people killed in “kidnapping-related incidents.”

THE UNSEEN VICTIMS OF WAR: HOW RUSSIA'S INVASION LEFT THOUSANDS OF DISABLED UKRAINIANS IN PERIL![]()

December 12, 2022

CBN will enforce fees for any customers withdrawing more than the allowed amount. Fees will range from 5% to 10%. However, it will allow larger withdrawals once per month for corporations and individuals under what they call “compelling circumstances.”

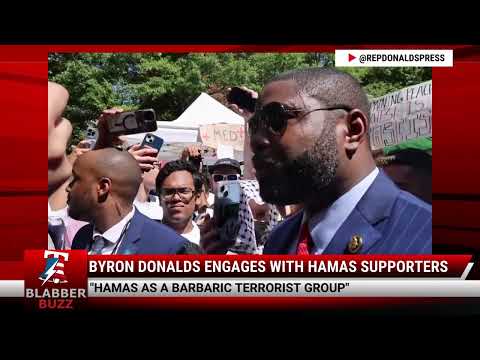

WATCH: BYRON DONALDS ENGAGES WITH HAMAS SUPPORTERS![]()

According to the Post Millennial, 40 million adults in Nigeria do business without using a bank.

The Netherlands Queen Maxima created a pre-recorded address for the B20 Summit Indonesia, where she advocates for central bank digital currencies. She serves as the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA).

WATCH MAYOR ADAMS: "YOU DON'T TAKE OVER OUR BUILDINGS AND PUT ANOTHER FLAG UP"![]()

Last month during the G20 Summit in Bali, Indonesia, digital transformation was discussed regarding reaching sustainable development goals.

In a letter, the CBD noted that their customers should “be encouraged to use alternative channels (internet banking, mobile banking, apps, USSD, cards/POS, eNaira, etc.) to conduct their banking transactions.”

WATCH: DOJ SET TO INDICT TEXAS DEMOCRAT REP.HENRY CUELLER, WHAT'S AT STAKE, YOU ASK?![]()

On the Gateway Pundit’s article, a commenter, Whitehorse, posted, “Fight digital currency to the utmost. It means social scoring and slavery. Think China. That is their “model.”

The CBD’s policy to limit withdrawals goes into effect on January 9.

Discover alternative ideas that will make you think

Discover alternative ideas that will make you think Engage in mind bending debate

Engage in mind bending debate Earn points, rise in rank, have fun

Earn points, rise in rank, have fun