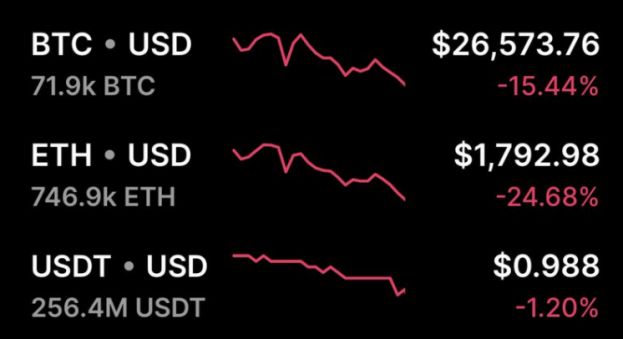

According to a Sunday report from Forbes, the price of Bitcoin dropped to under $35,000, its lowest price since July of last year. The decline comes in the face of the largest Federal Reserve rate hike in years.

Furthermore, other top ten cryptocurrencies, including Ethereum, BNB, XRP, Solana, LUNA, Cardano, and Avalanche, are all laboring, falling to lows not seen since January.

Bitcoin hit an intra-day low of $32,650.02, its lowest level since July 2021. This year, the virtual currency has been bartering in a narrow range as it attempts to reclaim its highs of late 2021. It is now down more than 50% from its pinnacle price of $68,990.90 in November 2021.

WATCH: JOHN LEGEND CALLS TRUMP A RACIST![]()

Forbes reports that the Bitcoin Fear and Green Index has plunged into the "extreme fear" category amidst the fall. And it's not just crypto markets taking the blow; this week, the Nasdaq recorded its longest weekly losing streak since 2012.

RUSSIAN COURT DENIES EVAN GERSHOVICH'S APPEAL, WHAT'S NEXT FOR THE WSJ REPORTER?![]()

Tammy Da Costa, an analyst at DailyFX, writes that "the correlation between cryptocurrency and equities has been consulted fairly extensively after bitcoin and the tech-heavy Nasdaq displayed a higher favorable correlation than was initially expected," but notes that predictions made before Russia invaded Ukraine were made under the assumption that once interest rates rise, supply and demand would meet.

WATCH FETTERMAN REACTING TO PROTESTS WAVES![]()

However, she adds that "fundamentals have included interest rate anticipations " over the past week. Nobody can ignore the ongoing war that continues to place pressure on supply constraints, particularly for commodities."

HRMMM...RUSSIAN PRIEST THAT LEAD NAVALNY'S MEMORIAL SERVICE SUDDENLY 'DISMISSED' BY MOSCOW CHURCH![]()

Meanwhile, the Federal Reserve on Wednesday increased its benchmark interest rate by half a percentage point in retort to inflation pressures.

The stock market rallied after Fed chair Jerome Powell said a more extensive rate hike of 75 basis points isn’t being regarded. But by Thursday, investors had erased the Fed rally’s gains.

SQUATTERS BEWARE AS GEORGIA GOVERNOR SIGNS TOUGH NEW LAW![]()

“Overall markets remain under pressure from inflation and growth fears,” declared Vijay Ayyar, vice president of corporate development and international at crypto exchange Luno. He expressed that if bitcoin falls below $30,000, it could even drop further to $25,000 before any “significant” move back up.

EXECUTION-STYLE AMBUSH: LOS ANGELES DEPUTY ATTACKED BY NOTORIOUS GANG MEMBER![]()

The global market cap for cryptocurrencies was at $1.68 trillion on Sunday, according to data from CoinGecko.com, and cryptocurrency trading volume on the last day was at $119 billion. Crypto investors were also on edge over the weekend after the TerraUSD stable coin briefly lost its dollar peg.

PLOT TWIST ALERT: GEORGE SANTOS' EPIC EXIT THROWS CAMPAIGN CIRCUS INTO HILARIOUS CHAOS![]()

A stable coin is a digital currency developed to peg its value to real-world assets. Issuers of stable coins frequently back their virtual currencies with other assets held in reserves. In this case, TerraUSD seeks to be pegged to the U.S. dollar.

GOOGLE'S "NO POLITICS" POLICY IN ACTION: AND THEY MEAN BUSINESS!![]()

The Luna Foundation Guard, which is behind TerraUSD, has been buying up large amounts of bitcoin in its reserves.

However, the price of TerraUSD shortly slipped away from parity with the U.S. dollar over the weekend before recovering. This has sparked fears that the Luna Foundation Guard could sell bitcoin to prop up TerraUSD.

“The crypto markets are also a bit nervous after UST (Terra stable coin) lost its peg briefly over the weekend,” Ayyar stated.

Discover alternative ideas that will make you think

Discover alternative ideas that will make you think Engage in mind bending debate

Engage in mind bending debate Earn points, rise in rank, have fun

Earn points, rise in rank, have fun