The state constitution caps the top state income tax rate for individuals at 6%. Senate Bill 159 by Sen. Bret Allain, the Republican who chairs his chamber’s Revenue and Fiscal Affairs Committee, would reduce the maximum top rate to 5%.

The amendment further would strike from the constitution the state’s income tax break for federal taxes paid. Allain announced a companion statute would set a 4.25% top rate and abolish the tax break.

Policy wonks across the political spectrum have called for eliminating the federal income tax break, which sets state tax policy at the mercy of the federal government. When Congress decreases the federal income tax rate, it effectively causes a state tax increase in Louisiana, and the opposite likewise is true.

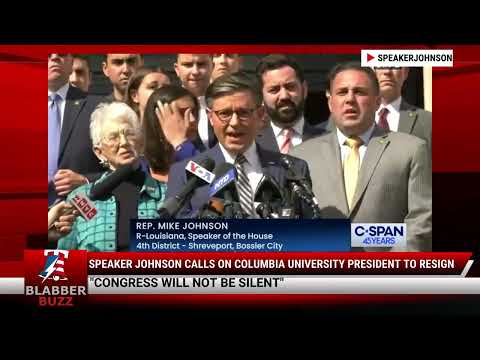

WATCH: SPEAKER JOHNSON CALLS ON COLUMBIA UNIVERSITY PRESIDENT TO RESIGN![]()

Cutting the state tax rate offsets the loss for higher-income taxpayers of the lucrative tax break.

“We’re trying to do this as revenue-neutral as possible,” Allain stated.

While no one disputed eliminating the federal income tax break, the tax rate change was more doubtful. Jan Moller with the Louisiana Budget Project, which directs on how state policy affects low- and middle-income residents, claimed that the state needs to raise revenue, pointing to teacher salaries that are well below the regional average as one example where more spending is required.

WATCH GREAT ANALYSIS: THE ABSURDITY OF ANTI-ISRAEL PROTESTS![]()

Moller further announced the state’s high sales tax rate, which forces lower-income residents to spend a larger proportion of their money on state taxes than those with higher earnings, makes Louisiana more of an outlier than the income tax rates.

A CRYING SHAME: PRO-PALESTINIAN PROTESTS FORCE USC TO CANCEL PRIMARY GRADUATION EVENT![]()

Sen. Karen Carter Peterson, D-New Orleans, opposed advancing the bill, stating she believed its two goals should be in two separate bills. Allain, however, said, politically, dropping the tax break won’t fly without lower tax rates. Lawmakers moved the bill with a 10-1 vote.

REPUBLICAN SENATORS EXPOSE DARK SIDE OF 'FOOD DELIVERY' ECONOMICS![]()

The committee further approved Senate Bill 161, which extends an exemption of the corporate franchise tax on the first $300,000 of taxable capital from its current sunset at the end of this fiscal year into 2025. About 80% of Louisiana corporations would not have to pay the tax at all, Allain said. The Department of Revenue said the change would reduce state revenue by about $7.5 million annually.

SEE TO BELIEVE: COMING SOON TO A KID'S DRAG SHOW NEAR YOU...(WATCH)![]()

All this seems to take place just as top U.S. business leaders are stepping up pressure on lawmakers to kill off a White House plan to sharply raise corporate taxes as part of President Joe Biden’s massive $2.3 trillion spending proposal.

The Business Roundtable, a group representing America’s largest companies, said in a new survey that 98% of CEOs believe raising corporate taxes would have a “moderately” to “very” negative impact on their companies.

Discover alternative ideas that will make you think

Discover alternative ideas that will make you think Engage in mind bending debate

Engage in mind bending debate Earn points, rise in rank, have fun

Earn points, rise in rank, have fun