Kerry didn’t embellish on the features of the order or the timing, but the step would meet a promise Biden made on the campaign path to require all public corporations to report their effusions and climate-related dangers.

Now, the Biden administration has taken several steps to sustain capacity at agencies such as the Treasury Department, the Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Federal Reserve to discuss the dangers climate change poses to the financial system. Last month, the SEC asked for input on installing a regime for climate exposures.

The early moves from Biden's team on climate finance have already brought harsh denunciation from Republican lawmakers, who say the administration's attempts are a politically motivated attempt to choke off capital to fossil fuels.

Kerry, during talks Wednesday at a virtual event hosted by the International Monetary Fund, said climate disclosure requirements will shift the allocation of capital.

THE UNSEEN VICTIMS OF WAR: HOW RUSSIA'S INVASION LEFT THOUSANDS OF DISABLED UKRAINIANS IN PERIL![]()

“Suddenly, people are going to be making evaluations considering long-term risks to their investment based on the climate crisis,” Kerry said. “And that will encourage new investment, as well as laws in countries,” such as tax incentives to support clean energy technologies, he added.

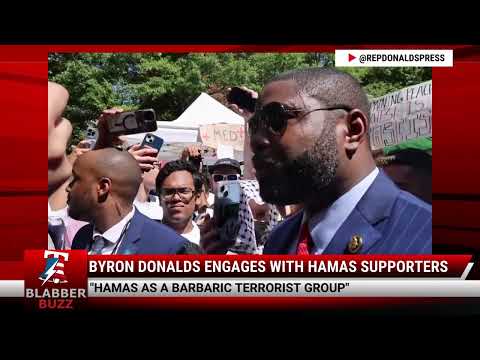

WATCH: BYRON DONALDS ENGAGES WITH HAMAS SUPPORTERS![]()

Kerry’s comments came following comments from IMF Managing Director Kristalina Georgieva saying that managing and regulating climate disclosures is an important role for global financial entities.

WATCH MAYOR ADAMS: "YOU DON'T TAKE OVER OUR BUILDINGS AND PUT ANOTHER FLAG UP"![]()

“We have to make the invisible visible — the transition risk that banks are carrying because they’re invested in high-carbon activities that, over time, are going to be phased out and the physical risks, investments in highly vulnerable coastal areas or in agriculture that could be affected by floods or droughts,” Georgieva said.

WATCH: DOJ SET TO INDICT TEXAS DEMOCRAT REP.HENRY CUELLER, WHAT'S AT STAKE, YOU ASK?![]()

Knowing what dangers banks and companies face is predominant, she said, and the IMF is trying to stress test those levels of risk to ascertain how well the economic system could handle them. Georgieva said big investment firms are also asking for disclosures so they can understand their own possible risks.

THE HAWAII BILLIONAIRE BATTLE: MEET THE RECLUSIVE RICHEST MAN ON THE ISLAND...![]()

Environmental advocates have broadly welcomed the Biden administration’s actions thus far on climate finance. They see admission requirements as a vital component of the U.S. approach to controlling climate change.

“That alone will not get us to a net-zero future, but we will never, never get to a net-zero future without mandatory, across-the-board climate disclosure,” said Steven Rothstein, managing director of the Ceres Accelerator for Sustainable Capital Markets.

“We are anticipating the executive order and are hopeful that it will send a positive and strong signal across the marketplace,” he added.

Discover alternative ideas that will make you think

Discover alternative ideas that will make you think Engage in mind bending debate

Engage in mind bending debate Earn points, rise in rank, have fun

Earn points, rise in rank, have fun